Traders who do not deviate from the basic analysis know that IQ Options provides a financial calendar that can be viewed directly on the website here. The financial calendar highlights important financial events that can affect certain assets and price fluctuations. How do you read the financial calendar and understand a lot of difficult information to explain?

In fact, understanding the financial calendar improves the strategy of many traders. However, at first glance, the calendar may seem complicated. Below is a detailed explanation of the meaning of events in the financial calendar.

How do you read the financial calendar?

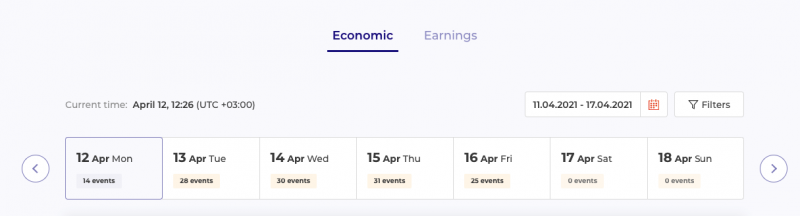

First look at the structure of the financial calendar, we have the information. To do this, we divide the financial calendar page into several sections and consider each one separately.

Filters: type, date, effect, etc.

The first part of the calendar is the settings that allow you to customize the calendar. Here you can choose whether you are interested in financial news like unemployment reports, budget balance sheets, swelling rates, or pay articulations of a specific organization. When closed, you can go to the “Win” tab.

Another scenario where you can change the date – check the flow weeks or months before or after, depending on your interests.

By clicking the “Channel” button, you’ll create the list, select particular nations, select money related occasion categories, and channel by weight (“Moo”, “Medium”, “Tall” influence).

Information and predictions

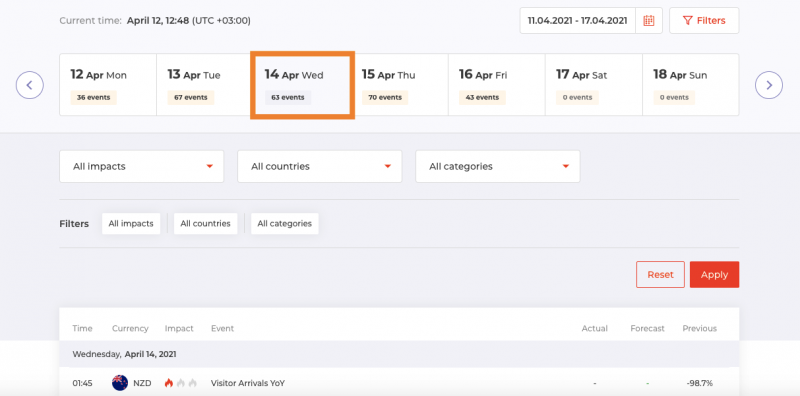

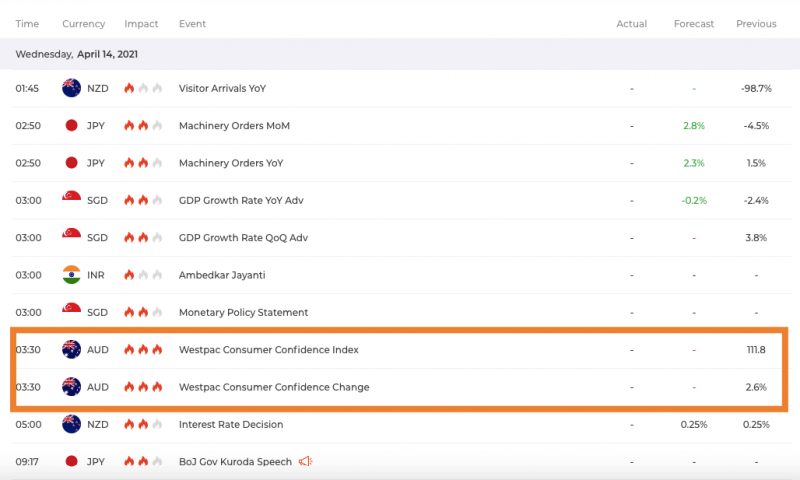

After selecting Wednesday, April 14th, we will get a calendar of events for that day. This list can represent many events that are expected to hit the market. The unemployment report can be a budget report, as mentioned earlier, or a very important part of political language.

As described, events can be filtered by country, region, or influence. In the list below, we look at two high-impact events, each marked with three fire phrases. The effect shows how many events can increase the volatility of a particular asset market.

Each event shows the time, expected meaning, impact rate, title, and three output columns: OK, Forecast, and Previous. All three columns reflect the change in the value of our assets.

The figure appears the anticipated comes about for a specific news fragment (e.g., the rate alter in intrigued rates). Appears already distributed “past” comes about for a particular news segment. “Unique” comes about will be shown after the news is declared.

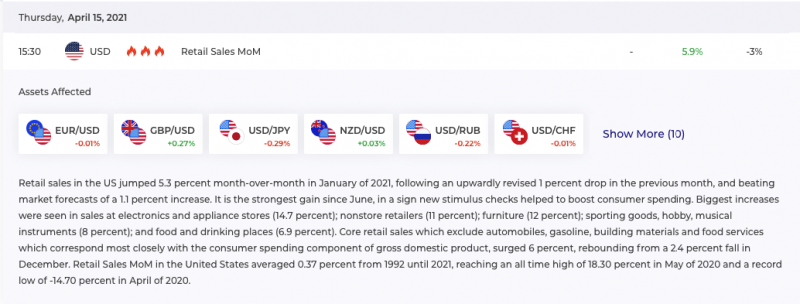

As soon as you submit the message you will get detailed information about the originator of the attack. In this case Forex and USD pairs are included. MoM retail is a measure of consumer spending that represents a significant amount of economic activity in the United States. You see, the average price is 5.9% and the first -3%.

How do you get that statement?

A higher-than-expected reading (above 5.9%) is a sign of a stronger US dollar and indicates a slower-than-expected growth. -The forecast shows a downward trend in the US dollar. Of course, news does not affect things. Some reports are weak and do not cover market activity as important.

It is important to follow a general financial calendar

which is especially useful for investors who want to know when prices will rise and who want to expect strong or weak movements. You have a financial record for your business

If you want to start with a financial calendar, first think about the trading methods where it works.

If you are a Forex trader, you can choose a partner in the currency of your choice and take the time to listen to more trades.

Learn more about your chosen marketing source. Compare your previous results with your project and work with your plan. You can keep a sales diary so that you can record your work, track results and much more.

Install marketing and financial tools to reduce market risk. Remember that past actions are not a reflection of future actions.